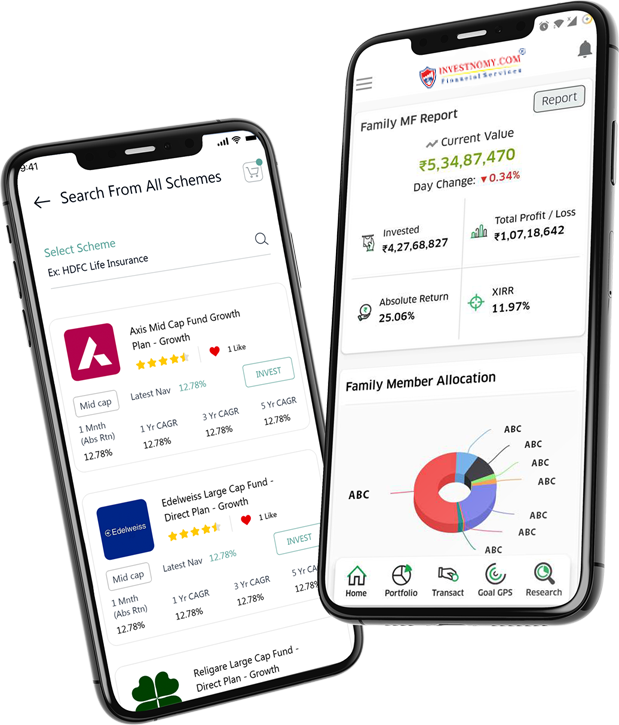

Welcome to Investnomy, your trusted financial companion in India. We understand that your financial journey is more than just numbers; it's a story of dreams, aspirations, and the legacy you want to leave behind. At Investnomy, we are driven by the belief that everyone deserves a secure and prosperous future.

Our journey began with a simple promise: to empower every individual in India to achieve their financial goals and protect what matters most. We know that life's uncertainties can be overwhelming, but with the right guidance and support, you can navigate them successfully.

Our dedicated team of financial experts is committed to providing you with the best guidance and services tailored to your unique needs. We take pride in the relationships we've built with our clients, and their success stories inspire us every day.